Catastrophe Risk Models 101: What They Are, How They Work, and Uses

PART 2: How are Catastrophe Models Used?

In part 1 of this series, we introduced how catastrophe modeling simulates the interaction of hazard, exposure, and vulnerability to quantify the risk of loss in terms of exceedance probabilities. This post will discuss how these risk estimates can be used.

Catastrophe risk models help companies anticipate the likelihood of potential future catastrophes so that they can appropriately prepare for their financial impact [1, 2, 3]. Catastrophe models can shine light on several considerations, including the location, size, and frequency of potential catastrophic events [1, 2, 3].

Insurance/reinsurance companies use catastrophe models to estimate the loss potential, or risk, to their books of business and to provide them with the tools and information they need to manage that risk [1, 2, 3, 4]. The companies manage their risk using a variety of approaches, including: defining underwriting guidelines, limiting their exposure in regions, and purchasing reinsurance.

Catastrophe risk models can also be used for other purposes. The models can be used to develop mitigation strategies such as the development of building regulations. The cost-effectiveness of a mitigation strategy can be assessed through benefit-cost analyses based on scenarios. For example, are actions such as building elevated homes in coastal regions vulnerable to hurricane storm surge cost-effective [1, 2]? Other types of catastrophe models can be used to estimate possible personal injuries and fatalities [2, 4]. The models are also a component of an insurance company’s rate filing in a state. Other information includes risk from non-catastrophe events, the companies’ operational expenses, profit margins, and the cost of reinsurance purchases.

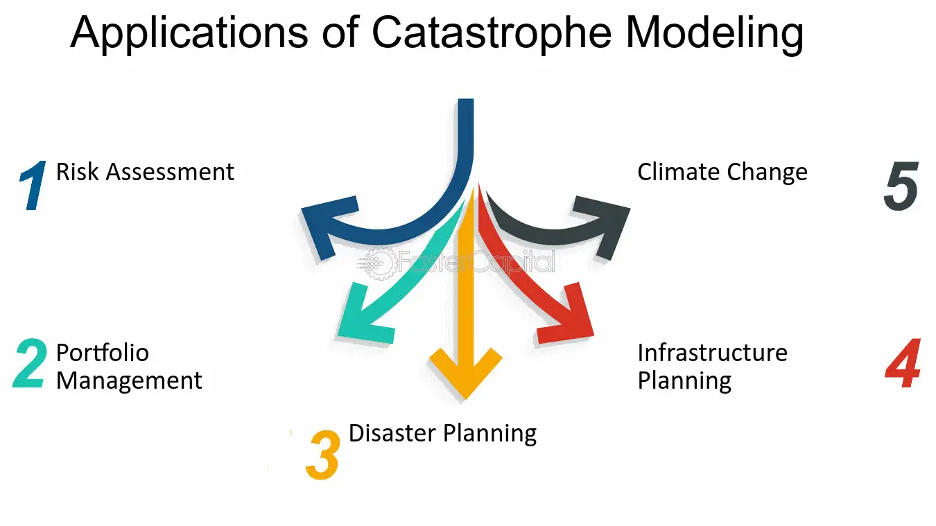

There is a growing range of organizations using catastrophe models to assess and manage their natural catastrophe risk. These include government agencies, financial services companies such as mortgage lenders, risk pools, and owners of high-value real estate [1, 3, 4]. For example, governments are utilizing catastrophe models to identify and quantify risks to populations and infrastructure, formulate effective mitigation strategies, and inform disaster financing programs [1]. Catastrophe models themselves are continually evolving as science advances, new data and technologies become available, and as users and businesses demand novel solutions to emerging global problems [1]. A summary of some of the most common applications of catastrophe modeling is shown in Figure 1.

Figure 1: The various applications of catastrophe modeling. Graphic borrowed from: https://fastercapital.com/content/Catastrophe-Modeling--Predicting-Disasters-with-Actuarial-Science.html.

Here at Kinetic Analysis Corporation, we have utilized our modeling capabilities to assist clients in a variety of sectors across the globe. These include some of the largest insurance brokers, disaster risk managers, and government organizations such as the Department of Agriculture Foreign Agricultural Service. Willis Towers Watson (WTW) recently stated in an interview with KAC that they have used our tropical cyclone wind field data to “design and implement parametric insurance products that support humanitarian response and ecosystem restoration activities.” These include the UNICEF Parametric Insurance Programme [5] and the MAR Insurance Programme [personal communication], both of which are currently on the market. WTW also stated that in the case of the UNICEF Parametric Insurance Programme, they also use the live, real-time data provided by KAC to determine whether the product has triggered the insurance programme.

In the area of risk management, KAC continues to provide useful and life-saving information. KAC has worked closely with the Pacific Disaster Center (PDC) in Hawaii to provide them with timely, detailed information on the hazards associated with ongoing tropical cyclones. KAC has also worked with the African Risk Capacity (ARC) for several years now. ARC is a specialized agency of the African Union established to help African governments improve their capacities to plan, prepare, and respond to extreme weather events and natural disasters [6]. For other clients we have generated thousands of updated, quality-controlled hazard products based on a storm’s position, intensity, size, and asymmetry using best-track data from Regional Specialized Meteorological Centers worldwide [7]. The hazard data include wind, waves, surge, and rain at varying spatial resolutions and in various data formats.

No matter the industry, Kinetic Analysis Corporation is committed to providing you with high-quality, up-to-date information on the hazards and impacts associated with tropical cyclones. For more information about our plans and pricing, please visit www.kinanco.com and look under the “Products” tab or email us at aagastra@kinanco.com.

References

1. https://www.air-worldwide.com/SiteAssets/Publications/Brochures/documents/about-catastrophe-models

2. https://www.rms.com/catastrophe-modeling?contact-us=cat-modeling#:~:text=Catastrophe%20modeling%20allows%20insurers%20and,hurricanes%20to%20floods%20and%20wildfires.

3. https://journals.ametsoc.org/view/journals/bams/85/11/bams-85-11-1713.xml

4. https://www.actuary.org/sites/default/files/files/publications/Catastrophe_Modeling_Monograph_07.25.2018.pdf

5. https://www.wtwco.com/en-hk/insights/2023/07/an-unusually-large-number-of-category-5-tropical-cyclones

6. https://www.arc.int/

7. https://www.nhc.noaa.gov/aboutrsmc.shtml